Bankruptcy Timeline

Important times to know when filing bankruptcy in Tucson, AZ

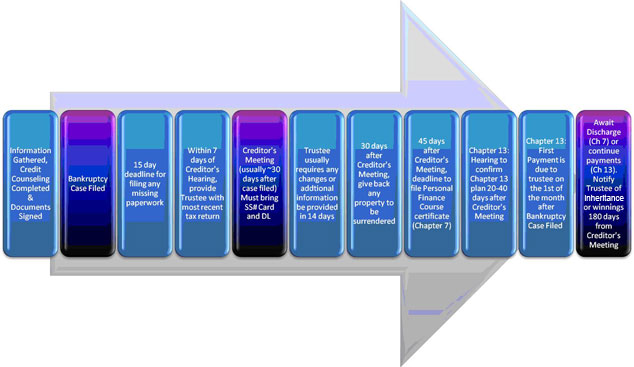

The specific timeline and process involved in a bankruptcy case will vary depending upon whether you file a chapter 7 bankruptcy or a chapter 13 bankruptcy. Our Tucson bankruptcy law firm offers a free initial consultation to discuss your particular debt relief strategy. We can also help you make sense of the process and paperwork involved in a bankruptcy. We have included waiting periods, important time periods, and basic timelines for bankruptcy cases in Tucson, Arizona.

8 Years Before Filing – You must wait 8 years to file a Chapter 7 bankruptcy case if you have already received a discharge from a prior Chapter 7. In some cases, you may be eligible to file 6 years after a Chapter 13 bankruptcy discharge.

4 Years Before Bankruptcy – You must wait at least 4 years to file for a Chapter 13 bankruptcy if you have already filed for Chapter 7 previously. For a prior Chapter 13 case, you need only wait 2 years after the bankruptcy discharge.

180 Days Before Filing – You must undergo training from a certified credit counseling agency in order to be eligible to file for bankruptcy.

90 Days Before Filing – You must be a resident in the state in which you are filing for a minimum of 90 days prior to filing your bankruptcy petition with the court.

Filing – Your bankruptcy case officially begins when you file your bankruptcy petition with the bankruptcy court.

15 Days After Filing – You have 15 days after filing for bankruptcy to provide the court with specific information about assets, expenses, liabilities, income and more. For a Chapter 13 case, you must also file your repayment plan within this time period.

30 Days After Filing – Chapter 7: You must file a Statement of Intention, which basically states which, if any, debts you wish to reaffirm. Chapter 13: Approximately 30 days after you file your repayment plan with the bankruptcy court, you must make your first scheduled payment.

45 Days After Filing – The court will hold a Meeting of Creditors (also referred to as a 341 Hearing) approximately 6 weeks after your case is filed.

180 Days After Filing – Government agencies that have claims against you, such as taxes owed to the IRS, will have 180 days after the date of your petition to submit proof of their claims against you.

3 to 5 Years After Filing (Chapter 13 only) –Approximately 3 to 5 years after the date of your first payment based off your Chapter 13 repayment plan, you will receive a formal discharge from the bankruptcy court. All eligible debts will then be discharged.