Chapter 13 Bankruptcy

It’s Not for Everyone, Is It For You?

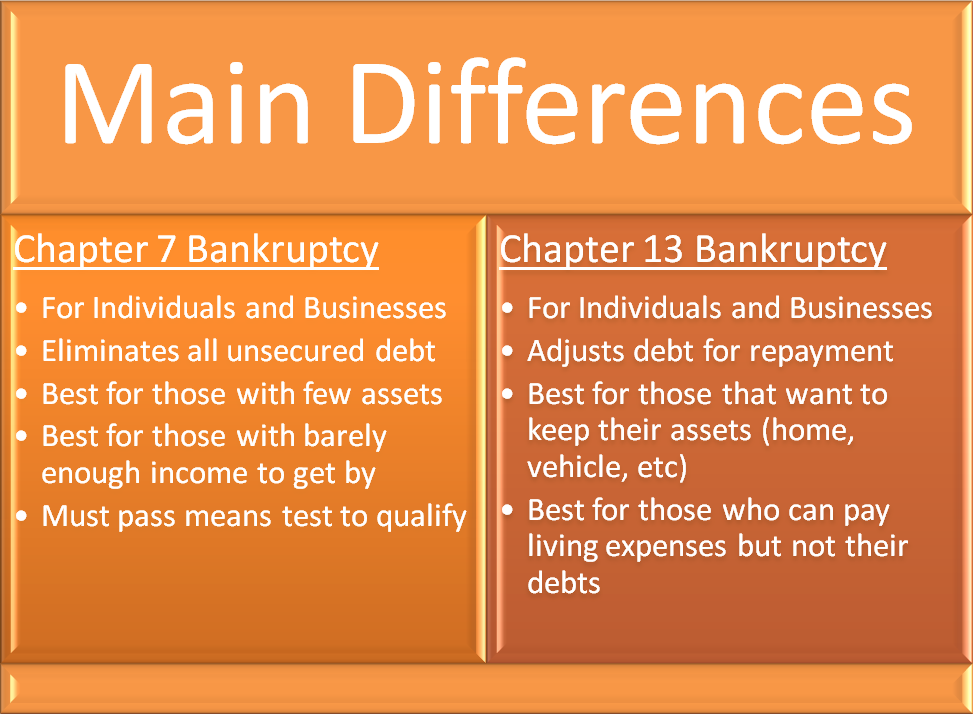

Unlike Chapter 7 Bankruptcy, which completely discharges your debt, Chapter 13 bankruptcy allows you to set up an affordable plan for repaying a portion of your debt. Following successful completion of your customized, three- or five-year bankruptcy plan, your remaining unsecured debt will be discharged. Chapter 13 is not for everyone, you have to have a minimum income in order to qualify for the Chapter 13 repayment plan.

In order to create a feasible Chapter 13 bankruptcy repayment plan, an experienced Chapter 13 bankruptcy lawyer will carefully examine your income, expenses (such as your mortgage and car payments), and your debt, in order to craft a repayment plan that works for you. Believe it or not, quite often people who file for chapter 13 bankruptcy protection see their credit scores increase within one year of filing Chapter 13 bankruptcy.

If you are facing foreclosure or repossession, you may not know where to turn. Even if you’re unsure about bankruptcy, if you want to keep your home and possessions, it would be a good idea to speak to a knowledgeable bankruptcy attorney. Not all bankruptcy lawyers are experienced in Chapter 13 bankruptcy. There is a lot more to a chapter 13 bankruptcy than there is to a Chapter 7 bankruptcy. Thus, many less experienced attorneys throw their hat in to the ring of bankruptcy attorney and attempt to file bankruptcies without as much experience as they should.

Filing a chapter 13 bankruptcy usually stops collection actions against debtors — garnishments, creditor phone calls, and lawsuits. After filing for chapter 13 bankruptcy protection, the debtor works with a trustee and the creditors in order to develop a payment plan. A person with a steady income, who is self-employed, or for someone operating an unincorporated business, chapter 13 bankruptcy is an option that allows the debtor to create and submit a plan to repay their debt over a period of time.

Filing chapter 13 is choosing to rehabilitate finances. You are allowed time to pay of debts without losing your personal property or home/real estate. If you are ineligible for chapter 7 bankruptcy, you may want to pursue chapter 13. If you are risking foreclosure on your home, chapter 13 may allow you to establish a payment schedule to repay the mortgage and stop foreclosure proceedings. Also, there are some debts that may not be discharged under the bankruptcy code (child support, student loans, spousal support). A plan under Chapter 13 can help ease the financial burdens of these types of debt. A relief not given on these debts in a chapter 7 bankruptcy.

Chapter 13 can be complex; you will need to file an official petition, calculate your debts, and make payments per your repayment plan. Chapter 13 is not for everyone; it may not be the best bankruptcy format for your particular financial situation. If you wish to file chapter 13, or if you have questions about filing, seek the advice of an experienced bankruptcy attorney. A knowledgeable Tucson bankruptcy lawyer will be able to help you make the best decisions for your particular bankruptcy case and assist you with the legal documentations and help you better understand bankruptcy law.